Page 177 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 177

NHS Resolution Annual report and accounts 2021/22 153

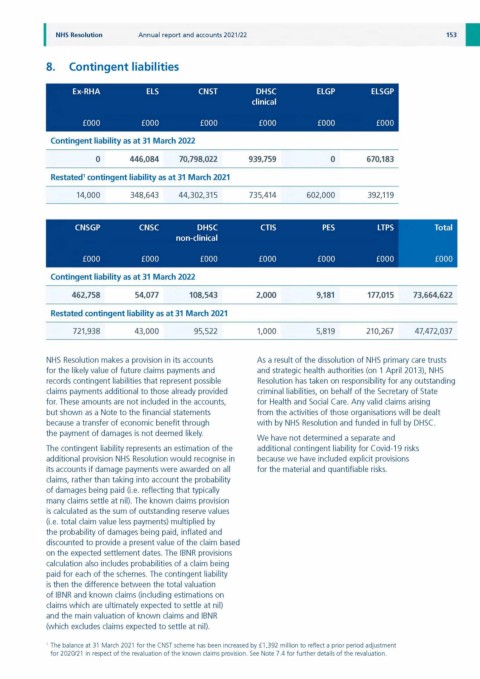

8. Contingent liabilities

Ex-RHA ELS CNST DHSC ELGP ELSGP

clinical

£ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0

Contingent liability as at 31 March 2022

0 446,084 70,798,022 939,759 0 670,183

Restated1contingent liability as at 31 March 2021

14,000 348,643 44,302,315 735,414 602,000 392,119

CNSGP CNSC DHSC CTIS PES LTPS Total

non-clinical

£ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0 £ 0 0 0

Contingent liability as at 31 March 2022

462,758 54,077 108,543 2,000 9,181 177,015 73,664,622

Restated contingent liability as at 31 March 2021

721,938 43,000 95,522 1 , 0 0 0 5,819 210,267 47,472,037

NHS Resolution makes a provision in its accounts As a result of the dissolution of NHS primary care trusts

for the likely value of future claims payments and and strategic health authorities (on 1 April 2013), NHS

records contingent liabilities that represent possible Resolution has taken on responsibility for any outstanding

claims payments additional to those already provided criminal liabilities, on behalf of the Secretary of State

for. These amounts are not included in the accounts, for Health and Social Care. Any valid claims arising

but shown as a Note to the financial statements from the activities of those organisations will be dealt

because a transfer of economic benefit through with by NHS Resolution and funded in full by DHSC.

the payment of damages is not deemed likely.

We have not determined a separate and

The contingent liability represents an estimation of the additional contingent liability for Covid-19 risks

additional provision NHS Resolution would recognise in because we have included explicit provisions

its accounts if damage payments were awarded on all for the material and quantifiable risks.

claims, rather than taking into account the probability

of damages being paid (i.e. reflecting that typically

many claims settle at nil). The known claims provision

is calculated as the sum of outstanding reserve values

(i.e. total claim value less payments) multiplied by

the probability of damages being paid, inflated and

discounted to provide a present value of the claim based

on the expected settlement dates. The IBNR provisions

calculation also includes probabilities of a claim being

paid for each of the schemes. The contingent liability

is then the difference between the total valuation

of IBNR and known claims (including estimations on

claims which are ultimately expected to settle at nil)

and the main valuation of known claims and IBNR

(which excludes claims expected to settle at nil).

The balance at 31 March 2021 for the CNST scheme has been increased by £1,392 million to reflect a prior period adjustment

for 2020/21 in respect of the revaluation of the known claims provision. See Note 7.4 for further details of the revaluation.