Page 172 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 172

148 Financial statements

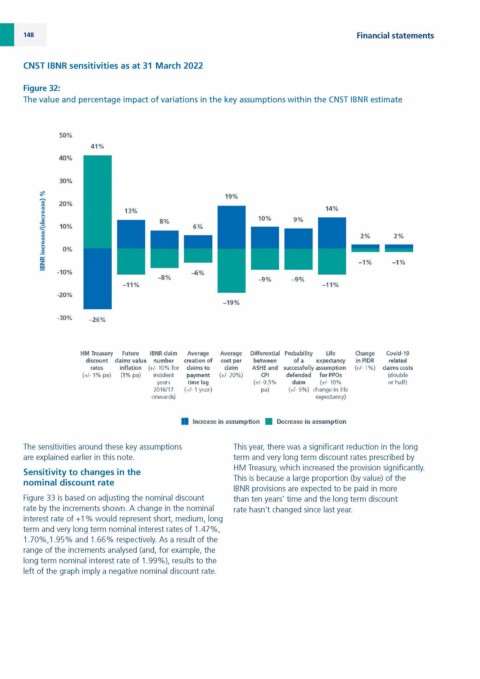

CNST IBNR sensitivities as at 31 March 2022

Figure 32:

The value and percentage impact of variations in the key assumptions within the CNST IBNR estimate

50%

41%

-30% -26%

HM Treasury Future IBNR claim Average Average Differential Probability Life Change Covid-19

discount claims value number creation of cost per between of a expectancy in PIDR related

rates inflation (+/-10% for claims to claim ASHE and successfully assumption (+7-1%) claims costs

(+/-1% pa) (1% pa) incident payment (+/- 20%) CPI defended for PPOs (double

years time lag (+/- 0.5% daim (+7- 10% or half)

2016/17 ( >t 1year) pa) (if 5%) change in life

onwards) expectancy)

H Increase in assumption ■ Decrease in assumption

The sensitivities around these key assumptions This year, there was a significant reduction in the long

are explained earlier in this note. term and very long term discount rates prescribed by

HM Treasury, which increased the provision significantly.

Sensitivity to changes in the

This is because a large proportion (by value) of the

nominal discount rate

IBNR provisions are expected to be paid in more

Figure 33 is based on adjusting the nominal discount than ten years' time and the long term discount

rate by the increments shown. A change in the nominal rate hasn't changed since last year.

interest rate of +1 % would represent short, medium, long

term and very long term nominal interest rates of 1.47%,

1.70%,1.95% and 1.66% respectively. As a result of the

range of the increments analysed (and, for example, the

long term nominal interest rate of 1.99%), results to the

left of the graph imply a negative nominal discount rate.