Page 167 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 167

NHS Resolution Annual report and accounts 2021/22 143

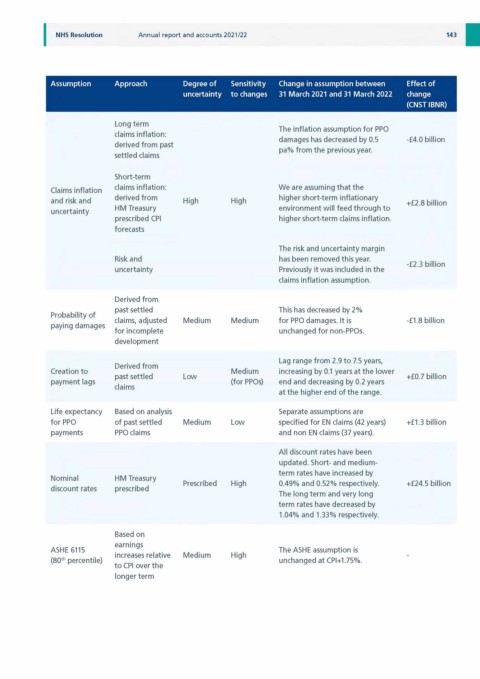

Assumption Approach Degree of Sensitivity Change in assumption between Effect of

uncertainty to changes 31 March 2021 and 31 March 2022 change

(CNST IBNR)

Long term

The inflation assumption for PPO

claims inflation:

damages has decreased by 0.5 -£4.0 billion

derived from past

pa% from the previous year.

settled claims

Short-term

claims inflation: We are assuming that the

Claims inflation

derived from higher short-term inflationary

and risk and High High +£2 . 8 billion

HM Treasury environment will feed through to

uncertainty

prescribed CPI higher short-term claims inflation.

forecasts

The risk and uncertainty margin

Risk and has been removed this year.

-£2.3 billion

uncertainty Previously it was included in the

claims inflation assumption.

Derived from

past settled This has decreased by 2%

Probability of

claims, adjusted Medium Medium for PPO damages. It is -£1 . 8 billion

paying damages

for incomplete unchanged for non-PPOs.

development

Lag range from 2.9 to 7.5 years,

Derived from

Creation to Medium increasing by 0 . 1 years at the lower

past settled Low +£0.7 billion

payment lags (for PPOs) end and decreasing by 0 . 2 years

claims

at the higher end of the range.

Life expectancy Based on analysis Separate assumptions are

for PPO of past settled Medium Low specified for EN claims (42 years) +£1.3 billion

payments PPO claims and non EN claims (37 years).

All discount rates have been

updated. Short- and medium-

term rates have increased by

Nominal HM Treasury

Prescribed High 0.49% and 0.52% respectively. +£24.5 billion

discount rates prescribed

The long term and very long

term rates have decreased by

1.04% and 1.33% respectively.

Based on

earnings

ASHE 6115 The ASHE assumption is

increases relative Medium High -

(80th percentile) unchanged at CPI+1.75%.

to CPI over the

longer term