Page 169 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 169

NHS Resolution Annual report and accounts 2021/22 145

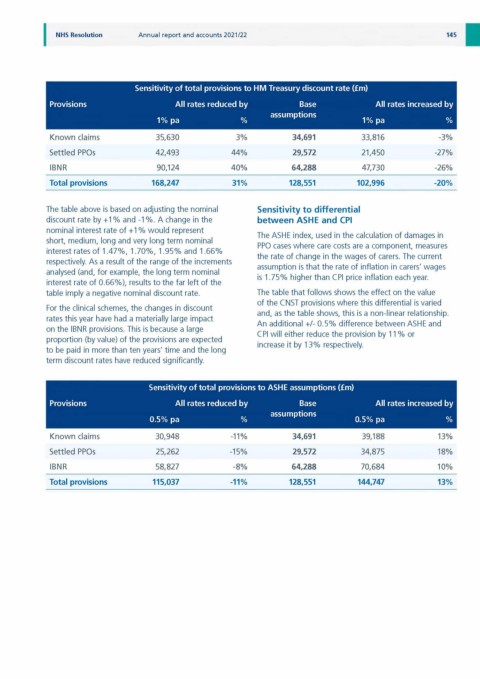

Sensitivity of total provisions to HM Treasury discount rate (f m)

Provisions All rates reduced by Base All rates increased by

assumptions

1% pa % 1% pa %

Known claims 35,630 3% 34,691 33,816 -3%

Settled PPOs 42,493 44% 29,572 21,450 -27%

IBNR 90,124 40% 64,288 47,730 -26%

Total provisions 168,247 31% 128,551 102,996 -20%

The table above is based on adjusting the nominal Sensitivity to differential

discount rate by +1 % and -1 %. A change in the between ASHE and CPI

nominal interest rate of +1 % would represent

The ASHE index, used in the calculation of damages in

short, medium, long and very long term nominal

PPO cases where care costs are a component, measures

interest rates of 1.47%, 1.70%, 1.95% and 1.66%

the rate of change in the wages of carers. The current

respectively. As a result of the range of the increments

assumption is that the rate of inflation in carers' wages

analysed (and, for example, the long term nominal

is 1.75% higher than CPI price inflation each year.

interest rate of 0.66%), results to the far left of the

table imply a negative nominal discount rate. The table that follows shows the effect on the value

of the CNST provisions where this differential is varied

For the clinical schemes, the changes in discount

and, as the table shows, this is a non-linear relationship.

rates this year have had a materially large impact

An additional +/- 0.5% difference between ASHE and

on the IBNR provisions. This is because a large

CPI will either reduce the provision by 11 % or

proportion (by value) of the provisions are expected

increase it by 13% respectively.

to be paid in more than ten years' time and the long

term discount rates have reduced significantly.

Sensitivity of total provisions to ASHE assumptions (f m)

Provisions All rates reduced by Base All rates increased by

assumptions

0.5% pa % 0.5% pa %

Known claims 30,948 -1 1 % 34,691 39,188 13%

Settled PPOs 25,262 -15% 29,572 34,875 18%

IBNR 58,827 -8 % 64,288 70,684 1 0 %

Total provisions 115,037 -11% 128,551 144,747 13%