Page 168 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 168

144 Financial statements

Sensitivities as at 31 March 2022

The provisions are sensitive to the assumptions used Sensitivity to HM Treasury tiered

to varying degrees. The following demonstrates nominal discount rates

the sensitivity to these assumptions by showing:

Since 2018/19, HM Treasury specifies discount rates in

• Sensitivity of the total provisions (known nominal terms. The short- and medium-term nominal

claims, settled PPOs and IBNR) to changes discount rates have increased this year and the long term

in the following key assumptions: rates have both decreased. The impacts of these changes

on the provisions vary by scheme, depending on the type

- HM Treasury discount rates

and duration of the expected future claim payments.

- ASHE assumption

Due the long term nature of the liabilities, claims

- Claims inflation that have settled, or are expected to settle as

a PPO are very sensitive to changes in the HM

- Life expectancy.

Treasury-prescribed discount rate, especially the

• For CNST IBNR provisions, which represent the long term and very long term discount rates.

single largest element within the total provision:

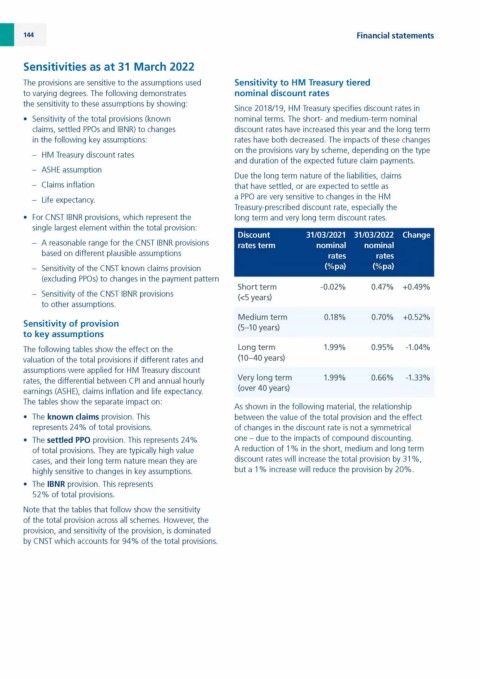

Discount 31/03/2021 31/03/2022 Change

- A reasonable range for the CNST IBNR provisions rates term nominal nominal

based on different plausible assumptions rates rates

- Sensitivity of the CNST known claims provision (%pa) (%pa)

(excluding PPOs) to changes in the payment pattern

Short term -0 .0 2 % 0.47% +0.49%

- Sensitivity of the CNST IBNR provisions

(<5 years)

to other assumptions.

Medium term 0.18% 0.70% +0.52%

Sensitivity of provision

(5-10 years)

to key assumptions

The following tables show the effect on the Long term 1.99% 0.95% -1.04%

valuation of the total provisions if different rates and (10-40 years)

assumptions were applied for HM Treasury discount

Very long term 1.99% 0 .6 6 % -1.33%

rates, the differential between CPI and annual hourly

(over 40 years)

earnings (ASHE), claims inflation and life expectancy.

The tables show the separate impact on:

As shown in the following material, the relationship

• The known claims provision. This between the value of the total provision and the effect

represents 24% of total provisions. of changes in the discount rate is not a symmetrical

• The settled PPO provision. This represents 24% one - due to the impacts of compound discounting.

of total provisions. They are typically high value A reduction of 1% in the short, medium and long term

cases, and their long term nature mean they are discount rates will increase the total provision by 31 %,

highly sensitive to changes in key assumptions. but a 1% increase will reduce the provision by 20%.

• The IBNR provision. This represents

52% of total provisions.

Note that the tables that follow show the sensitivity

of the total provision across all schemes. However, the

provision, and sensitivity of the provision, is dominated

by CNST which accounts for 94% of the total provisions.