Page 158 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 158

134 Financial statements

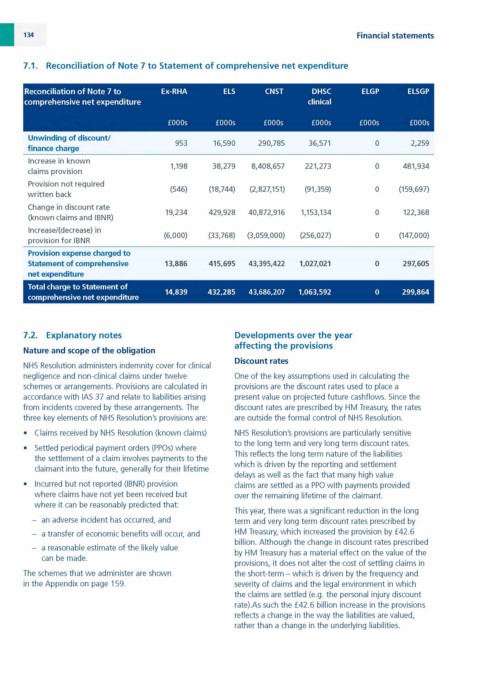

7.1. Reconciliation of Note 7 to Statement of comprehensive net expenditure

Reconciliation of Note 7 to Ex-RHA ELS CNST DHSC ELGP ELSGP

comprehensive net expenditure clinical

£0 0 0 s £0 0 0 s £0 0 0 s £0 0 0 s £0 0 0 s £0 0 0 s

Unwinding of discount/

953 16,590 290,785 36,571 0 2,259

finance charge

Increase in known

1,198 38,279 8,408,657 221,273 0 481,934

claims provision

Provision not required

(546) (18,744) (2,827,151) (91,359) 0 (159,697)

written back

Change in discount rate

19,234 429,928 40,872,916 1,153,134 0 122,368

(known claims and IBNR)

lncrease/(decrease) in

(6 ,0 0 0 ) (33,768) (3,059,000) (256,027) 0 (147,000)

provision for IBNR

Provision expense charged to

Statement of comprehensive 13,886 415,695 43,395,422 1,027,021 0 297,605

net expenditure

Total charge to Statement of

14,839 432,285 43,686,207 1,063,592 0 299,864

comprehensive net expenditure

7.2. Explanatory notes Developments over the year

affecting the provisions

Nature and scope of the obligation

Discount rates

NHS Resolution administers indemnity cover for clinical

negligence and non-clinical claims under twelve One of the key assumptions used in calculating the

schemes or arrangements. Provisions are calculated in provisions are the discount rates used to place a

accordance with IAS 37 and relate to liabilities arising present value on projected future cashflows. Since the

from incidents covered by these arrangements. The discount rates are prescribed by HM Treasury, the rates

three key elements of NHS Resolution's provisions are: are outside the formal control of NHS Resolution.

• Claims received by NHS Resolution (known claims) NHS Resolution's provisions are particularly sensitive

to the long term and very long term discount rates.

• Settled periodical payment orders (PPOs) where

This reflects the long term nature of the liabilities

the settlement of a claim involves payments to the

which is driven by the reporting and settlement

claimant into the future, generally for their lifetime

delays as well as the fact that many high value

• Incurred but not reported (IBNR) provision claims are settled as a PPO with payments provided

where claims have not yet been received but over the remaining lifetime of the claimant.

where it can be reasonably predicted that:

This year, there was a significant reduction in the long

- an adverse incident has occurred, and term and very long term discount rates prescribed by

- a transfer of economic benefits will occur, and HM Treasury, which increased the provision by £42.6

billion. Although the change in discount rates prescribed

- a reasonable estimate of the likely value

by HM Treasury has a material effect on the value of the

can be made.

provisions, it does not alter the cost of settling claims in

The schemes that we administer are shown the short-term - which is driven by the frequency and

in the Appendix on page 159. severity of claims and the legal environment in which

the claims are settled (e.g. the personal injury discount

rate).As such the £42.6 billion increase in the provisions

reflects a change in the way the liabilities are valued,

rather than a change in the underlying liabilities.