Page 81 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 81

NHS Resolution Annual report and accounts 2021/22 57

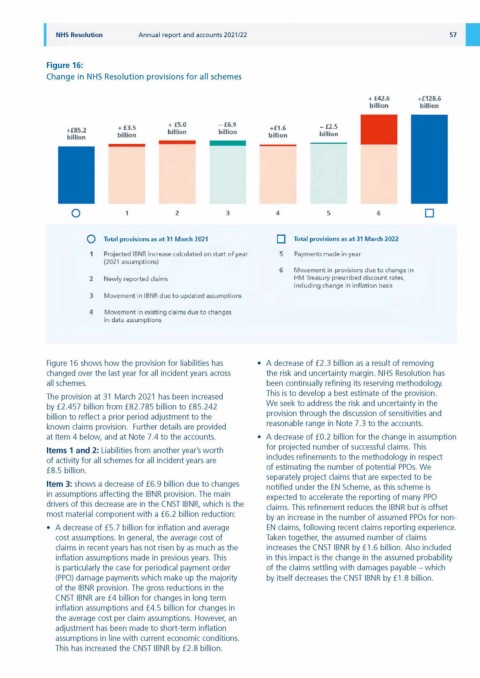

Figure 16:

Change in NHS Resolution provisions for all schemes

Q Total provisions as at 31 March 2021 I | Total provisions as at 31 March 2022

1 Projected IBNR increase calculated on start of year 5 Payments made in year

(2021 assumptions)

6 Movement in provisions due to change in

2 Newly reported claims HM Treasury prescribed discount rates,

including change in inflation basis

3 Movement in IBNR due to updated assumptions

4 Movement in existing claims due to changes

in data assumptions

Figure 16 shows how the provision for liabilities has • A decrease of £2.3 billion as a result of removing

changed over the last year for all incident years across the risk and uncertainty margin. NHS Resolution has

all schemes. been continually refining its reserving methodology.

This is to develop a best estimate of the provision.

The provision at 31 March 2021 has been increased

We seek to address the risk and uncertainty in the

by £2.457 billion from £82.785 billion to £85.242

provision through the discussion of sensitivities and

billion to reflect a prior period adjustment to the

reasonable range in Note 7.3 to the accounts.

known claims provision. Further details are provided

at Item 4 below, and at Note 7.4 to the accounts. • A decrease of £0.2 billion for the change in assumption

for projected number of successful claims. This

Items 1 and 2: Liabilities from another year's worth

includes refinements to the methodology in respect

of activity for all schemes for all incident years are

of estimating the number of potential PPOs. We

£8.5 billion.

separately project claims that are expected to be

Item 3: shows a decrease of £6.9 billion due to changes notified under the EN Scheme, as this scheme is

in assumptions affecting the IBNR provision. The main

expected to accelerate the reporting of many PPO

drivers of this decrease are in the CNST IBNR, which is the

claims. This refinement reduces the IBNR but is offset

most material component with a £6.2 billion reduction:

by an increase in the number of assumed PPOs for non-

• A decrease of £5.7 billion for inflation and average EN claims, following recent claims reporting experience.

cost assumptions. In general, the average cost of Taken together, the assumed number of claims

claims in recent years has not risen by as much as the increases the CNST IBNR by £1.6 billion. Also included

inflation assumptions made in previous years. This in this impact is the change in the assumed probability

is particularly the case for periodical payment order of the claims settling with damages payable - which

(PPO) damage payments which make up the majority by itself decreases the CNST IBNR by £1.8 billion.

of the IBNR provision. The gross reductions in the

CNST IBNR are £4 billion for changes in long term

inflation assumptions and £4.5 billion for changes in

the average cost per claim assumptions. However, an

adjustment has been made to short-term inflation

assumptions in line with current economic conditions.

This has increased the CNST IBNR by £2.8 billion.