Page 121 - Pharmacy Appeals 1/4/04 to 31/3/05

P. 121

NHS Resolution Annual report and accounts 2021/22 97

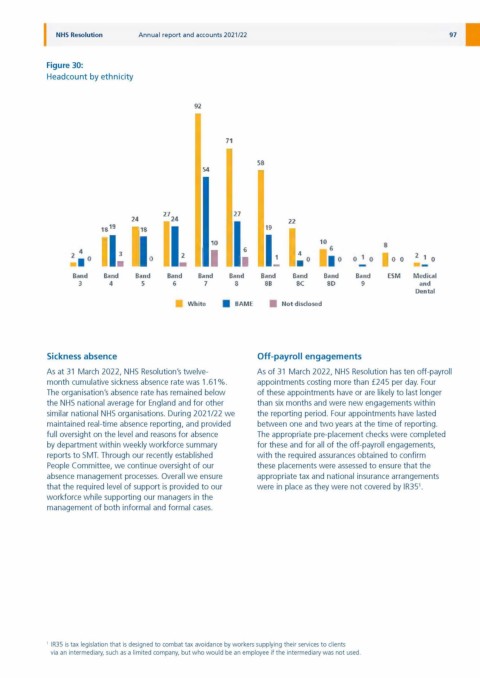

Figure 30:

Headcount by ethnicity

92

White | BAME ■ Not disclosed

Sickness absence Off-payroll engagements

As at 31 March 2022, NHS Resolution's twelve As of 31 March 2022, NHS Resolution has ten off-payroll

month cumulative sickness absence rate was 1.61 %. appointments costing more than £245 per day. Four

The organisation's absence rate has remained below of these appointments have or are likely to last longer

the NHS national average for England and for other than six months and were new engagements within

similar national NHS organisations. During 2021/22 we the reporting period. Four appointments have lasted

maintained real-time absence reporting, and provided between one and two years at the time of reporting.

full oversight on the level and reasons for absence The appropriate pre-placement checks were completed

by department within weekly workforce summary for these and for all of the off-payroll engagements,

reports to SMT. Through our recently established with the required assurances obtained to confirm

People Committee, we continue oversight of our these placements were assessed to ensure that the

absence management processes. Overall we ensure appropriate tax and national insurance arrangements

that the required level of support is provided to our were in place as they were not covered by IR351.

workforce while supporting our managers in the

management of both informal and formal cases.

IR35 is tax legislation that is designed to combat tax avoidance by workers supplying their services to clients

via an intermediary, such as a limited company, but who would be an employee if the intermediary was not used.